Introduction: Who This Guide Is For and Why JBSP Matters

This guide is intended for first-time buyers struggling to get on the property ladder, parents or family members aiming to support their child or relative in purchasing their first home, and families considering joint mortgage options to increase borrowing power. It provides comprehensive information about the joint borrower sole proprietor mortgage (JBSP) in the UK.

In this guide, you will find detailed explanations of:

- Eligibility criteria and typical requirements for JBSP mortgages

- The step-by-step JBSP mortgage process

- Key advantages and disadvantages of JBSP mortgages

- Stamp duty and tax implications associated with JBSP

- Alternative mortgage options to JBSP

- Real-world examples and frequently asked questions

Understanding JBSP mortgages is essential in the current UK property market, where rising house prices and strict affordability checks make it challenging for many buyers, especially first-time buyers, to secure a mortgage independently. JBSP mortgages offer a practical solution for families seeking financial support without sharing legal ownership of the property.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements

Key Points Summary

- A joint borrower sole proprietor mortgage allows multiple people to be named on a mortgage, but only one person holds legal ownership of the property.

- JBSP mortgages enable family members to combine incomes to increase borrowing capacity without sharing ownership.

- They are particularly useful for first-time buyers needing financial support to meet lender affordability criteria.

- Supporting borrowers share joint liability for mortgage repayments but have no legal claim to the property or its equity.

- JBSP mortgages can preserve first-time buyer stamp duty relief and avoid additional property surcharges.

- Independent legal advice is required for non-owner borrowers to understand their responsibilities.

- Exit strategies and future borrowing impacts should be carefully planned before entering a JBSP arrangement.

Quick JBSP Overview

A joint borrower sole proprietor mortgage (JBSP) is a mortgage arrangement where multiple individuals are named on the mortgage application, but only one person is registered as the legal owner of the property. This means family members can lend their income to enhance borrowing power without acquiring any ownership rights.

This structure is commonly used by first-time buyers in England and Wales who require assistance from parents or close family members to meet lender affordability checks in 2024–2025. With the average first-time buyer age now approximately 34 years and deposits often requiring 10-15% of the property value, many buyers cannot secure sufficient borrowing based solely on their income.

JBSP mortgages allow individuals with lower incomes or smaller deposits to access larger loans by including supporting borrowers’ income. They are also suitable for buyers needing family support to satisfy lender criteria or increase borrowing capacity.

The primary reasons for choosing a JBSP mortgage include:

- Increased borrowing power by combining income from up to four people

- Preservation of first-time buyer stamp duty relief for the sole proprietor

- Avoidance of the 3% additional property surcharge that applies if supporting parents are named on the title deeds

- No requirement for parents to use their own property as security

Summary of JBSP Mortgage Advantages and Disadvantages

Advantages | Disadvantages |

|---|---|

Borrowing capacity can increase by 20-50% with family support | All borrowers’ credit files are at risk if payments are missed |

First-time buyer stamp duty relief is preserved | Supporting borrowers’ future borrowing capacity may be reduced |

Parents can assist without acquiring ownership | Non-owners have no legal claim to property equity |

More flexible than many guarantor schemes | Lack of clear agreements can strain family relationships |

Temporary arrangement until buyer’s income improves | Not all lenders offer JBSP mortgages |

JBSP mortgages are primarily used to assist first-time buyers, those with lower incomes, or individuals requiring family support to secure a mortgage. By including a family member’s income in the application, JBSP mortgages make homeownership achievable for buyers who might otherwise fail affordability assessments.

What is a Joint Borrower Sole Proprietor Mortgage?

A Joint Borrower Sole Proprietor (JBSP) mortgage is a mortgage product that allows two or more people to apply for a mortgage together, but only one person becomes the legal owner of the property. While all named borrowers share joint responsibility for the mortgage debt, only the sole proprietor appears on the title deeds and holds legal ownership.

Supporting borrowers, also known as non-owner borrowers, do not have any legal rights to the property, including no entitlement to equity, rental income, or proceeds from sale. Any increase in property value during the mortgage term benefits solely the proprietor. The mortgage holders are not named on the title deeds and have no legal claim over the property or any appreciation in its value.

Typically, the sole proprietor is the individual who will occupy the property as their main residence under a regulated residential mortgage. This differs from a simple parental gift, as supporting borrowers are named on the mortgage and are jointly liable for every monthly repayment.

Mortgage lenders generally allow up to four people to be named as borrowers on a JBSP mortgage. Common arrangements include:

- Parents supporting adult children (the most frequent scenario)

- Siblings assisting each other

- Other close family members such as grandparents, aunts, or uncles

- Occasionally, long-term partners where one wishes to retain sole legal ownership

How Does a JBSP Mortgage Work in Practice?

Understanding the practical application of a JBSP mortgage is essential for preparing for the mortgage application process. All borrowers, including family members or supporters, share joint responsibility for mortgage payments, regardless of legal ownership.

Step-by-Step JBSP Mortgage Process

The typical process involves the following steps:

- Initial enquiry: Contact a lender or mortgage broker to discuss eligibility and mortgage options.

- Affordability assessment: The lender evaluates the combined income of all applicants to determine borrowing capacity.

- Credit checks: The lender performs credit assessments on all applicants to evaluate risk and eligibility.

- Property search and offer: After establishing a budget, the buyer searches for a suitable property and makes an offer.

- Application and approval: The lender reviews the mortgage application, supporting documentation, and property details before making a lending decision.

All applicants must provide necessary documents such as proof of income and identification during the application.

Lender Assessment Process

Lenders assess JBSP applications by:

- Combining the qualifying income of all borrowers

- Reviewing each applicant’s financial commitments, including loans, credit cards, childcare costs, and existing mortgages

- Conducting comprehensive credit checks on all applicants

- Applying affordability stress tests, which simulate higher interest rates to ensure repayment capability

All borrowers sign the same mortgage deed and become jointly and severally liable. This means the lender can pursue any individual borrower for the full mortgage debt if others are unable to pay. If the sole proprietor fails to make monthly repayments, supporting borrowers must cover the shortfall or risk damage to their credit histories.

Only the sole proprietor is registered on the Land Registry title and appears on the purchase contract. Supporting borrowers have no legal ownership rights.

Typical Lender Rules in 2026

Before applying, it is important to understand typical lender criteria for JBSP mortgages, which usually include:

Criteria | Common Requirements |

|---|---|

Maximum number of applicants | 2 to 4, depending on lender |

Minimum age | 18 to 21 years |

Maximum age at mortgage term end | 70 to 80 years; some lenders allow older applicants with pension proof |

Occupancy requirement | At least one borrower (usually the sole proprietor) must occupy the property |

Relationship requirements | Often limited to immediate family; some lenders accept wider relatives |

Worked Example

A first-time buyer earning £28,000 annually with a £25,000 deposit could borrow approximately £126,000 on a 4.5x income multiple, allowing a maximum purchase price of around £151,000.

Adding a parent earning £40,000 as a joint borrower increases combined income to £68,000, enabling borrowing of approximately £306,000 and a maximum property price of £331,000.

Scenario | Combined Income | Approximate Maximum Borrowing (4.5x) | Purchase Price with £25,000 Deposit |

|---|---|---|---|

Buyer alone | £28,000 | £126,000 | £151,000 |

JBSP with parent | £68,000 | £306,000 | £331,000 |

This more than doubles the buyer’s purchasing power, potentially allowing access to larger or better properties.

JBSP vs Joint Mortgage vs Guarantor Mortgage

Understanding the differences between these mortgage types is important when choosing the best option.

Joint Borrower Sole Proprietor (JBSP) Mortgage

- Multiple people are named on the mortgage.

- Only one person holds legal ownership of the property.

- All borrowers share joint responsibility for mortgage repayments.

- Supporting borrowers have no equity stake or ownership rights.

Joint Mortgage

- All borrowers are named on both the mortgage and the title deeds.

- Borrowers share legal ownership and equity in the property.

- Ownership can be as joint tenants (equal shares) or tenants in common (specified shares).

- All parties share equity and stamp duty liability.

Guarantor Mortgage

- A guarantor agrees to cover mortgage payments if the main borrower defaults.

- The guarantor does not own the property or appear on the mortgage.

- Affordability is usually assessed separately for the guarantor and borrower.

- The guarantor typically has no day-to-day payment responsibility unless the borrower defaults.

When to Use Each Structure

Structure | Suitable For |

|---|---|

JBSP mortgage | First-time buyers needing income support while preserving stamp duty relief |

Joint mortgage | Couples or family members purchasing and owning property together |

Guarantor mortgage | Situations where supporters prefer limited involvement or offer assets rather than income |

Lender criteria vary significantly between these products. It is advisable to speak with one of our brokers at Fox Davidson, we will research and compare mortgage deals to find the most suitable option.

Eligibility, Criteria and How Much You Can Borrow

Typical Eligibility Requirements in 2024–2025

To qualify for a JBSP mortgage, applicants generally must:

- Be UK residents or hold an acceptable visa status

- Be at least 18 to 21 years old (depending on lender)

- Not exceed the maximum age limit at mortgage term end (typically 70 to 80 years), with some exceptions for pension income

- Have an acceptable credit history; not all borrowers need perfect credit scores

What Lenders Assess for Affordability

Lenders review documentation and financial commitments for each applicant, including:

- Payslips from the last three months

- P60 forms showing annual earnings

- Bank statements (usually three months)

- Details of bonuses, overtime, or commission payments

For self-employed applicants, lenders typically require:

- SA302 tax calculations

- Tax year overviews

- Two to three years of business accounts for company owners

Lenders also consider:

- Existing loan and credit card repayments

- Childcare and other regular outgoings

- Existing mortgage or buy-to-let commitments

- Other financial obligations

Income Multiples and Borrowing Calculations

Most lenders apply income multiples between 4 and 4.5 times combined income. Some professional or high-deposit cases may access multiples of 5 to 6 times. Including a supporting borrower can substantially increase borrowing power, as shown below:

Applicant Scenario | Income | Multiple | Maximum Borrowing |

|---|---|---|---|

Single buyer, standard criteria | £35,000 | 4.5x | £157,500 |

Single buyer, professional scheme | £35,000 | 5.5x | £192,500 |

JBSP: buyer + parent | £35,000 + £45,000 | 4.5x | £360,000 |

JBSP: buyer + both parents | £35,000 + £80,000 | 4.5x | £517,500 |

Lender Restrictions on Joint Borrowers

Many lenders restrict joint borrower eligibility to:

- Immediate family members (most common)

- Some lenders accept wider relatives such as aunts, uncles, or cousins

- A few specialist lenders may permit friends as joint borrowers

Applicants with adverse credit histories (missed payments, defaults, CCJs) may have limited JBSP options, though specialist lenders may consider applications at higher interest rates.

Stamp Duty Land Tax and Tax Implications of JBSP

One significant advantage of a JBSP mortgage is the potential for stamp duty savings. Only the legal owner is liable for stamp duty, so supporting family members do not trigger additional stamp duty charges that would apply if they were co-owners.

How SDLT is Calculated

Stamp duty is charged solely on the legal owner(s) named on the title. Therefore, if supporting parents already own property, their inclusion as non-owners on a JBSP mortgage does not affect stamp duty liability on the new purchase.

First-Time Buyer Relief

If the sole proprietor qualifies as a first-time buyer in England or Northern Ireland:

- No SDLT is payable on the first £425,000 of property value (for homes up to £625,000)

- This can result in substantial savings

Without JBSP, adding parents as joint owners would forfeit the first-time buyer relief and trigger the 3% additional property surcharge due to their existing property ownership.

SDLT Comparison Example

Ownership Structure | SDLT on £400,000 Purchase |

|---|---|

First-time buyer sole proprietor (JBSP) | £0 |

Joint ownership with parents who own other property | £12,000 (standard rates) + £12,000 surcharge = £24,000 |

Capital Gains Tax Considerations

Supporting borrowers have no beneficial interest in the property, so:

- They are not liable for capital gains tax on the property

- The property is excluded from their estate for inheritance tax purposes

- They remain free to purchase other investment properties without affecting this arrangement

Important Documentation

Non-owner borrowers typically sign a declaration confirming no beneficial interest in the property. This protects all parties and satisfies lender requirements regarding ownership structure.

Note: This information is not tax advice. Stamp duty thresholds and rules can change. Always consult a solicitor or tax adviser to confirm your position before proceeding.

Pros and Cons of a Joint Borrower Sole Proprietor Mortgage

Summary Table: Key Advantages and Disadvantages

Advantages | Disadvantages |

|---|---|

Increased borrowing capacity by 20-50% with family support | All borrowers’ credit files are affected if payments are missed |

Preservation of first-time buyer stamp duty relief | Supporting borrowers’ future borrowing capacity may be reduced |

Parents can assist without acquiring ownership | Supporting borrowers have no legal claim to equity |

More flexible than many guarantor schemes | Potential family relationship strain without clear agreements |

Temporary arrangement until buyer’s income improves | Limited availability from lenders |

Advantages of JBSP

- Combined income increases borrowing capacity, enabling buyers to access the property ladder sooner.

- Supporting borrowers provide financial assistance without acquiring legal ownership or equity rights.

- First-time buyer stamp duty relief is preserved, avoiding additional surcharge for parents who own other properties.

- The arrangement can be reviewed and supporters removed once the main buyer’s income improves, typically at remortgage.

- JBSP mortgages offer greater flexibility than guarantor schemes, with no need for parents to pledge their own assets.

- The sole proprietor retains full control over property decisions, including sale and maintenance.

Disadvantages of JBSP

- All borrowers’ credit histories are impacted equally if mortgage payments are missed, regardless of residence.

- Supporting borrowers’ borrowing capacity may be reduced due to joint liability for mortgage payments.

- Supporting borrowers bear financial risk without ownership benefits or equity gains.

- Without formal legal agreements, supporters contributing to deposits or repayments have no automatic right to reimbursement.

- JBSP mortgages are not offered by all lenders, requiring specialist advice.

- Mixing family relationships with mortgage responsibilities can create tension if expectations are unclear.

Families should seek independent legal advice and consider formal agreements outlining contributions, repayment expectations, and exit strategies.

Key Considerations Before Taking Out a JBSP Mortgage

A JBSP mortgage is a significant long-term commitment. Understanding the legal, financial, and personal implications is essential before proceeding.

Legal Advice Requirements

Many lenders require non-owner borrowers to obtain independent legal advice before completion. This ensures they fully understand:

- Joint responsibility for the mortgage debt

- Lack of legal ownership or equity interest

- Potential credit history and borrowing impacts

- Limited rights regarding property decisions

Even when not mandatory, independent legal advice is strongly recommended. Solicitors can also prepare deeds of trust or family agreements to clarify arrangements.

Future Planning Considerations

Before entering a JBSP agreement, discuss:

- Potential early retirement of supporting borrowers

- Need to release equity from supporters’ own property

- Intentions to purchase investment properties

- Possible changes in family relationships

- Plans to add partners to the mortgage in the future

Exit Strategy

Agree on how and when supporters will be removed, typically:

- After the initial deal period (usually 2-5 years) at remortgage

- When the sole proprietor’s income suffices to pass affordability checks independently

- When property value increases reduce the loan-to-value ratio

Protection and Insurance

Consider appropriate insurance to protect all income providers, such as:

- Life insurance to cover mortgage in the event of death

- Income protection insurance for illness or inability to work

- Critical illness cover providing lump sum payments on diagnosis

Consult protection specialists to ensure adequate coverage.

Impact on Credit and Future Borrowing

Joint liability means lenders treat the full mortgage payment as a commitment for all borrowers, potentially affecting applications for:

- Credit cards

- Car finance

- Personal loans

- Remortgages on supporters’ own homes

How to Set Up and Later Exit a JBSP Mortgage

The Application Process

The JBSP mortgage application with Fox Davidson typically involves:

- Initial consultation: Discuss goals, constraints, and potential supporting borrowers.

- Detailed fact-find: Collect information on income, commitments, credit history, and future plans for all applicants.

- Lender sourcing: Identify lenders offering JBSP mortgages matching the applicants’ profiles.

- Agreement in principle: Obtain initial borrowing confirmation before making property offers.

- Full application: Submit detailed mortgage application with supporting documents.

- Valuation and legal work: Lender arranges property valuation; solicitors handle conveyancing and legal advice.

Documents Typically Required

Employed Applicants | Self-Employed Applicants |

|---|---|

Valid identification (passport, driving licence) | Valid identification |

Proof of address (utility bill, bank statement) | Proof of address |

Last 3 months’ payslips | SA302 tax calculations for 2-3 years |

Latest P60 | Tax year overviews |

3 months’ bank statements | Business accounts |

Details of existing debts | Details of existing debts |

Removing Supporters Later

Supporters can be removed by:

- Remortgaging: The sole proprietor obtains a new mortgage in their name alone, subject to affordability checks.

- Product transfer: Some lenders allow removal of joint borrowers at the end of the initial deal period if affordability criteria are met.

- Sale and redemption: Selling the property and repaying the mortgage in full.

Removing a joint borrower requires:

- Affordability assessment on remaining borrower(s)

- Legal work and updated title documentation

- Lender approval of changes

Regular reviews at key points, such as the end of fixed-rate periods or significant income changes, are recommended.

Property Types, Lenders and Where JBSP Can Be Used

Acceptable Property Types

Most JBSP mortgages cover standard UK residential properties, including:

- Detached, semi-detached, and terraced houses

- Purpose-built flats

- Converted flats (subject to construction type)

- New-build houses (some restrictions on new-build flats)

Restrictions may apply to:

- Ex-local authority properties

- High-rise flats (above 4-6 storeys)

- Non-standard construction (timber frame, concrete, etc.)

- Properties above commercial premises

Residential Focus

JBSP products are designed for owner-occupied residential properties. The sole proprietor is expected to live in the property as their main residence.

Lender Availability

Not all high street banks offer JBSP mortgages. Availability varies, with some specialist building societies providing more flexible criteria.

Lenders may impose specific rules regarding:

- Maximum number of applicants

- Age limits at application and mortgage term end

- Acceptable relationships between borrowers

- Minimum income requirements

As JBSP specialist mortgage brokers we will match borrowers with suitable lenders.

Regional Considerations

JBSP mortgages are available throughout the UK, with regional differences:

- England and Wales: Standard Land Registry process; Stamp Duty Land Tax (SDLT) applies

- Scotland: Different legal processes and terminology; Land and Buildings Transaction Tax (LBTT) applies; independent Scottish legal advice required

- Northern Ireland: Similar to England with separate stamp duty provisions

Alternatives to a JBSP Mortgage

Several alternatives to JBSP mortgages may suit different circumstances:

Gifted Deposit

Family members gift money toward the deposit without being named on the mortgage. A declaration confirms the gift has no repayment expectation.

Suitable for: Families with cash support but no desire for ongoing liability.

Standard Joint Mortgage

All parties are named on the mortgage and title deeds, sharing ownership and stamp duty liability.

Suitable for: Couples or family members desiring shared ownership.

Guarantor Mortgage or Family Springboard Products

Parents use savings or property as security. Some products hold parental savings in linked accounts released after a set period.

Suitable for: Situations where supporters have assets rather than income to contribute.

Government Schemes

Examples include:

- Shared ownership: Buy a share and pay rent on the remainder

- First Homes scheme: Discounted new-build homes for eligible buyers

Suitable for: Buyers who qualify and lack family support.

Comparison Summary

Option | Ongoing Family Liability | Family on Title | Stamp Duty Position |

|---|---|---|---|

JBSP mortgage | Yes | No | First-time buyer relief preserved |

Gifted deposit | No | No | First-time buyer relief preserved |

Joint mortgage | Yes | Yes | Additional rate may apply |

Guarantor mortgage | Limited/conditional | No | Depends on structure |

It is advisable to compare total costs, risks, and implications of each option with a mortgage broker.

Example JBSP Scenarios

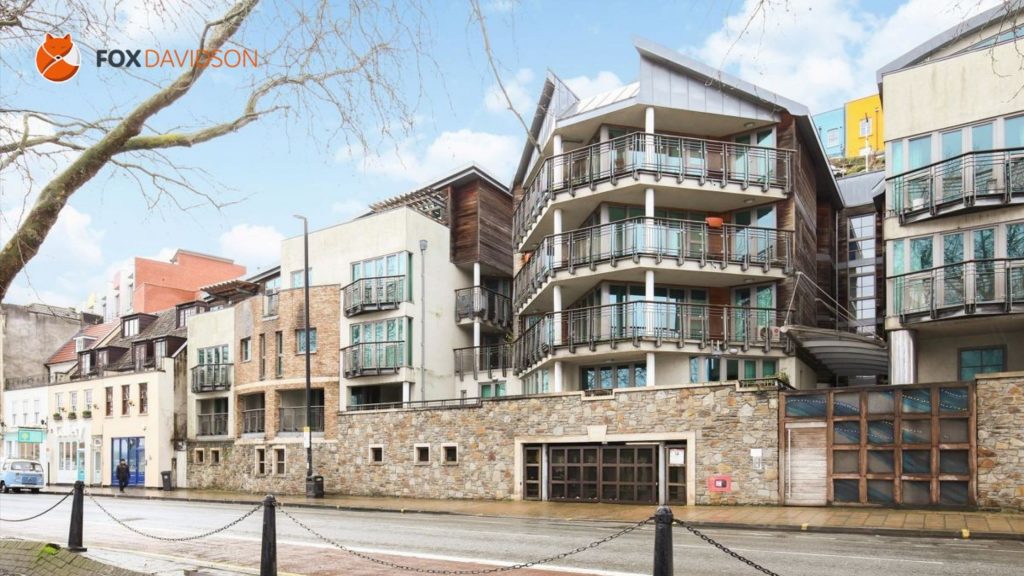

Scenario 1: Bristol First-Time Buyer in 2025

Emma, 28, earns £32,000 as a marketing manager in Bristol. She has £35,000 saved for a deposit and wants to buy a £325,000 two-bedroom flat.

- Without support, she could borrow approximately £144,000 (4.5x income), limiting her budget to £179,000.

- With her father David, 58, earning £50,000, joining as a supporting borrower, combined income is £82,000, allowing borrowing up to £369,000.

Factor | Without JBSP | With JBSP |

|---|---|---|

Maximum borrowing | £144,000 | £369,000 |

Deposit | £35,000 | £35,000 |

Affordable property | £179,000 | £404,000 |

Stamp duty | £0 (first-time buyer) | £0 (first-time buyer relief preserved) |

Exit plan: After a 5-year fixed rate, Emma expects a salary increase allowing her to remortgage independently.

Scenario 2: Self-Employed Buyer with Retired Parent

Marcus, 34, runs a graphic design business with £45,000 net profit annually. His variable income makes some lenders cautious. He wants to buy a £280,000 home in Manchester with a £40,000 deposit.

- Maximum borrowing assessed at £160,000 based on business income.

- His mother Angela, 67, has a guaranteed pension income of £28,000.

- A specialist lender accepting JBSP with pension income includes both incomes, allowing borrowing of £328,500.

- The lender’s maximum age at term end is 85, permitting a 17-year mortgage term for Angela.

Scenario 3: Siblings Supporting Each Other

Priya, 26, earns £25,000 in her first professional role. Her older brother Raj, 32, earns £55,000 and wants to help her buy a £250,000 flat in Birmingham. Raj owns his own property but does not want legal co-ownership.

- Raj joins as a supporting borrower, combining incomes to £80,000.

- This allows borrowing up to £360,000.

- Priya remains sole proprietor and qualifies for first-time buyer relief.

Ownership Structure | SDLT Payable |

|---|---|

JBSP (Priya sole proprietor) | £0 |

Joint ownership (Raj on title) | £10,000+ additional rate applies due to Raj’s ownership |

They create a family agreement for Raj’s removal within 5 years, with Priya paying slightly more than her share monthly to reflect support.

Working with Mortgage Brokers on a JBSP

As specialist mortgage brokers specialising in JBSP mortgages we assist clients by:

- Identifying lenders offering JBSP products and understanding their criteria

- Comparing JBSP, joint, and guarantor mortgage options

- Managing the application process, liaising with lenders, solicitors, and estate agents

- Advising on protection and exit strategies

Brokers help clients access the right lender and mortgage deal tailored to their circumstances, ensuring a smoother process.

Ready to explore JBSP mortgages? Contact a Fox Davidson for a free, no-obligation consultation to assess your situation and find suitable options.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements