Introduction to UK mortgages for International Clients & British Expats

An international mortgage in the UK is a specialist lending product designed for borrowers who live outside the United Kingdom or earn their income abroad but wish to purchase or refinance property in the UK. These mortgages serve UK expats working overseas, foreign nationals with no prior UK connection, and globally mobile professionals seeking to buy property or invest in one of the world’s most established property markets.

International mortgages are specifically provided to expats to help them finance buying property overseas, and many UK banks offer these products for UK residents or citizens purchasing property abroad.

This guide is written by Fox Davidson, award-winning UK mortgage brokers. We focus exclusively on high-value UK mortgages, arranging finance from £250,000 to £100m+ for residential & commercial property. Our expertise covers complex structures including SPV limited companies, offshore entities, and trusts, the kind of arrangements that our high-net-worth international buyers frequently require. Securing an international mortgage requires understanding the unique requirements of cross-border financing.

We specialise in helping clients navigate the additional scrutiny that comes with non-resident lending: foreign income verification, multi-currency considerations, and the enhanced due diligence that UK lenders apply to overseas applicants.

While lending criteria, maximum LTVs, and interest rates shift throughout the year, this article reflects 2026 market conditions and the current landscape shaped by the Bank of England’s monetary policy environment.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements

Summary: Key Facts About International Mortgages UK

- Specialist mortgages for borrowers living or earning income outside the UK purchasing or refinancing UK property.

- They serve UK expats, foreign nationals, and globally mobile professionals.

- Finance range: £250,000 up to £100 million+ for residential, buy to let and commercial mortgages as well as bridging and development finance.

- Expertise in complex ownership structures: SPVs, offshore companies, and trusts.

- Requires thorough foreign income verification and multi-currency loan considerations.

- Subject to enhanced due diligence and stricter eligibility criteria compared to domestic mortgages.

- Lending conditions influenced by Bank of England monetary policy and 2026 market environment.

Introduction to International Mortgage

An international mortgage, sometimes referred to as an overseas mortgage or expat mortgage, is a specialist loan designed for individuals purchasing or refinancing property in a country where they are not a resident. These mortgage products are particularly valuable for expats, foreign nationals, and high net worth individuals who wish to invest in property overseas, whether for a permanent move, a holiday home, or as part of a broader investment strategy.

International mortgage lenders offer a diverse range of financing options tailored to the unique needs of clients living and earning abroad. Whether you are looking to buy a holiday home in the Cotswolds, invest in a buy to let property in London, or secure a family residence in the South East, there are mortgage solutions available to suit your circumstances. The application process for overseas mortgages can be more complex than for domestic loans, often requiring additional documentation and careful navigation of local laws and regulations.

This is where international mortgage brokers play a crucial role. With expert guidance and deep knowledge of both local and international lending markets, brokers such as Fox Davidson help clients identify the most suitable mortgage products, manage the application process, and secure competitive terms. From initial enquiry to completion, we provide support at every stage, ensuring that expats and foreign nationals can purchase property abroad with confidence and clarity.

Whether your goal is to buy to let, purchase a holiday home, or expand your property investments across borders, working with experienced mortgage brokers ensures you have access to the best loan options and a stress-free process, no matter the country or complexity of your requirements.

Who Are International UK Mortgages For?

An international mortgage, sometimes called a non-resident mortgage or expat mortgage, is simply a loan secured against UK property where the borrower lives abroad or earns their primary income in a foreign currency. The fundamental mechanics mirror a standard UK mortgage, but the eligibility criteria, documentation requirements, and available lenders differ substantially.

These mortgage products serve several distinct client groups:

- UK expats living in key global hubs – Professionals based in the UAE (particularly Dubai and Abu Dhabi), Hong Kong, Singapore, Switzerland, the USA, and other jurisdictions who earn in foreign currency but wish to buy or refinance property in the UK. Many plan to return eventually; others want to maintain a UK asset base.

- Foreign nationals with no prior UK residence – Buyers from the Middle East, Asia, North America, Europe, and Africa purchasing property in London, Manchester, Birmingham, Bristol, Edinburgh, and other major UK cities. These clients may have never lived in the UK but see value in the market’s stability and legal framework.

- Internationally based property investors using UK limited companies – Investors building portfolios through SPV structures, acquiring HMOs, MUFBs (multi-unit freehold blocks), student accommodation, mixed-use buildings, and commercial assets. Corporate ownership often suits tax planning and succession strategies.

- High net worth individuals acquiring prime UK homes – Buyers seeking properties valued at £1m to £20m+ as second homes, pied-à-terres, or family bases linked to children’s education at UK boarding schools and universities in 2026.

- Business owners and professionals retaining a UK main residence – Clients who have relocated abroad but wish to keep or acquire a UK home for future return, family use, or simply as a stable store of wealth.

International mortgages can be tailored for various purposes, including buying permanent property, holiday homes, or investment properties.

Fox Davidson arrange finance for all these client groups, with loans ranging from £250,000 for straightforward purchases up to £100m+ for the most complex transactions, and all finance arrangements are handled on a case by case basis to reflect each client’s unique circumstances.

Key Scenarios We Help With

The following scenarios illustrate the types of international mortgage cases we handle regularly. Each represents a concrete buying or refinancing situation:

- UK expat in Dubai purchasing a London apartment – A professional on tax-free income wants to buy a £900,000 property in Zone 2 London, planning to return to the UK within 2–3 years. They require a 60–70% LTV mortgage with flexible terms that accommodate their non-resident status. Lenders will assess their ability to pay the required deposit and ongoing mortgage repayments, ensuring affordability based on international lending criteria.

- Non-UK resident parent buying near a Russell Group university – A Hong Kong-based family purchases a £1.2m UK property near Oxford or Cambridge for their children’s education, combining personal use with long-term investment potential.

- International investor acquiring a regional portfolio via SPV – A US or EU national uses a UK limited company to purchase a £3m portfolio of Manchester and Birmingham apartments, structured as a portfolio buy to let mortgage with rental income driving affordability.

- Overseas buyer purchasing a prime London townhouse – A Middle Eastern national acquires a £5m Knightsbridge or Mayfair property as a second home and wealth preservation vehicle, using interest-only or part-and-part repayment terms.

- UK expat in Singapore refinancing to release equity – A professional remortgages a £750,000 UK home to raise capital for further buy to let purchases, using a capital raise against existing equity.

- Developer based overseas acquiring a mixed-use building – An international developer purchases a £10m London building with commercial mortgage and bridging finance, planning to refurbish and convert upper floors to residential units.

- International client using regulated bridging finance – A UK expat needs to break a property chain or downsize quickly, using a £2m regulated bridging loan on their UK home while still living abroad.

Many countries have strict rules regarding debt, and if your total debt exceeds a certain percentage of your salary, you may be denied an international mortgage.

Types of International UK Mortgages & Property Finance

Non-residents and expats can access a range of mortgage solutions depending on their circumstances, property type, and investment objectives:

- International residential mortgages – For own-use homes, whether a main residence upon return to the UK or a second home for visits. Repayment, interest-only, and part-and-part options may be available depending on income and LTV.

- Expat and non-resident buy to let mortgages – Common for investment property purchases, often structured through UK SPV limited companies. Suitable for single properties, HMOs, MUFBs, and student accommodation blocks. Lenders typically stress-test rental income at 125–145% of mortgage payments.

- Semi-commercial and commercial mortgages – For mixed-use assets (retail with flats above, offices, warehouses, hospitality venues) acquired by international investors or business occupiers. These fall outside residential regulation and offer different structuring options.

- Development finance – For overseas developers funding ground-up construction, conversions, or heavy refurbishments. Usually structured as interest-only with drawdowns linked to build stages, repaid on sale or refinance.

- Bridging loans – Both regulated (for residential owner-occupied) and unregulated (for investment property). Ideal for auction purchases, chain breaks, and refurbishment projects where speed and flexibility are essential.

- Loan sizes and terms – Fox Davidson arrange international mortgages from £250,000 to £100m+ on property in the UK. Standard mortgage terms range from 2 to 40 years; bridging facilities typically run 6 to 24 months.

- Currency considerations – Some lenders offer foreign currency loans in USD, EUR, CHF, or other major currencies, matching the borrower’s income to reduce exchange rate risk. Multi-currency facilities may suit globally mobile clients with income streams in multiple currencies.

Holiday Home Financing for International Buyers

For international buyers dreaming of a holiday home in the UK or abroad, specialised mortgage solutions make this aspiration a reality. International mortgage lenders understand the unique requirements of non-UK residents, foreign nationals, and high net worth individuals seeking to invest in holiday properties. These lenders offer a range of mortgage products, including buy to let and expat mortgages, designed to accommodate the specific needs of overseas buyers.

Securing a mortgage for a holiday home involves meeting certain eligibility criteria, such as a minimum loan amount and a maximum loan to value (LTV) ratio, which can vary depending on the lender and the property’s location. Interest rates and repayment terms are tailored to reflect the borrower’s residency status and financial profile, ensuring flexibility and competitive pricing. Whether you are looking to invest in a countryside retreat, a coastal getaway, or a city apartment, there are mortgage solutions available to match your goals.

Navigating the application process for a holiday home mortgage can be complex, especially for non-UK residents and foreign nationals. This is where international mortgage brokers provide invaluable support. With expert guidance, we help you understand the eligibility criteria, prepare the necessary documentation, and liaise with lenders to secure the best possible terms. Our experience (advising clients since 2005) ensures a stress free process, allowing you to focus on finding the perfect holiday property and maximising the value of your investment.

Whether you are investing in the UK or looking for a holiday home abroad, working with our specialist mortgage brokers gives you access to a wide range of loan options, expert advice, and a seamless purchase experience from start to finish.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements

Eligibility & Typical Lender Criteria in 2026

Eligibility for international mortgages varies significantly by lender, nationality, country of residence, property type, and loan size. The following summarises key criteria that UK lenders assess:

- Residency status – Lenders take different approaches to UK citizens abroad versus EEA residents versus foreign nationals from specific jurisdictions. Countries like the UAE, USA, Hong Kong, Singapore, and Switzerland are generally well-accepted. Applicants from India, Nigeria, South Africa, and certain other jurisdictions may face additional scrutiny or restricted lender choice.

- Income requirements – Accepted sources include salaried income, bonuses, self-employment profits, dividends, rental income, and investment returns. All income must be verifiable with documentation in English or accompanied by certified translations. Lenders assess income sustainability and track record.

- Employment status – Preference for established employment history, typically 6–24 months in the current role. Self-employed applicants and business owners need a demonstrable track record, often 2–3 years of accounts. Contract workers and consultants may face additional requirements.

- Minimum income and loan size scrutiny – Larger loans (above £1m) attract stronger lender scrutiny. Complex or higher-risk profiles may result in reduced maximum loan amounts or lower LTV requirements.

- Credit history – A UK credit file helps but is not essential for all lenders. Where no UK credit history exists, lenders may rely on overseas credit reports, banking conduct, and professional references. Clean credit facilitates access to better rates and terms.

- Deposit and loan to value expectations – Many international buyers need deposits of 25–40% of property value. Lower LTVs apply for complex structures, commercial deals, or applicants from higher-risk jurisdictions. Some prime residential lenders may stretch to 75% LTV for strong applicants.

- Property types – Lenders favour modern, mortgageable properties in liquid markets. Harder-to-finance assets include those with very short leases (under 70 years), non-standard construction, or requiring heavy works before they become lettable.

Comparison: UK Resident vs UK Expat vs Non-Resident Foreign National

Criteria | UK Resident Buyer | UK Expat Living Abroad | Non-Resident Foreign National |

|---|---|---|---|

Typical Maximum LTV | 85–95% | 70–75% | 60–70% |

UK Credit History Required | Yes | Preferred but not essential | Not essential |

Documents Required | Standard UK income/ID docs | UK + overseas employment/income docs | Overseas income, ID, visa/residence docs |

Rate Expectations | Most competitive | Slight premium | Moderate premium |

Lender Choice | Full market | Reduced panel | Specialist lenders |

Locations for Mortgage Financing in the UK

The UK property market offers a wealth of opportunities for international buyers, with mortgage financing available across a diverse range of locations. From the vibrant urban centres of London, Manchester, and Birmingham to the picturesque countryside of England, Scotland, and Wales, international mortgage lenders provide tailored solutions for properties throughout the country.

Premier customers benefit from exclusive international mortgage services, including access to VIP property searches, local market insights, and bespoke financing packages. Whether you are a non-UK resident, a foreign national, or a UK resident seeking to invest in a new region, there are mortgage options to suit your needs. Eligibility criteria and documentation requirements will vary depending on your residency status, the property type, and the lender’s policies, but expert guidance is available every step of the way.

International mortgage services provided by Fox Davidson ensure that clients receive comprehensive support throughout the application process. From initial consultation to completion, our experienced advisers help you navigate the complexities of securing a mortgage in the UK, providing clarity on eligibility, documentation, and lender expectations. This support is especially valuable for clients investing from abroad, ensuring a smooth and efficient process regardless of location.

Whether you are looking to buy a city apartment, a rural estate, or a coastal retreat, the UK offers a wide range of property options and mortgage solutions. With the right expert guidance and support, international buyers can confidently invest in UK property and enjoy the benefits of one of the world’s most dynamic real estate markets.

The International Mortgage Process – Step by Step

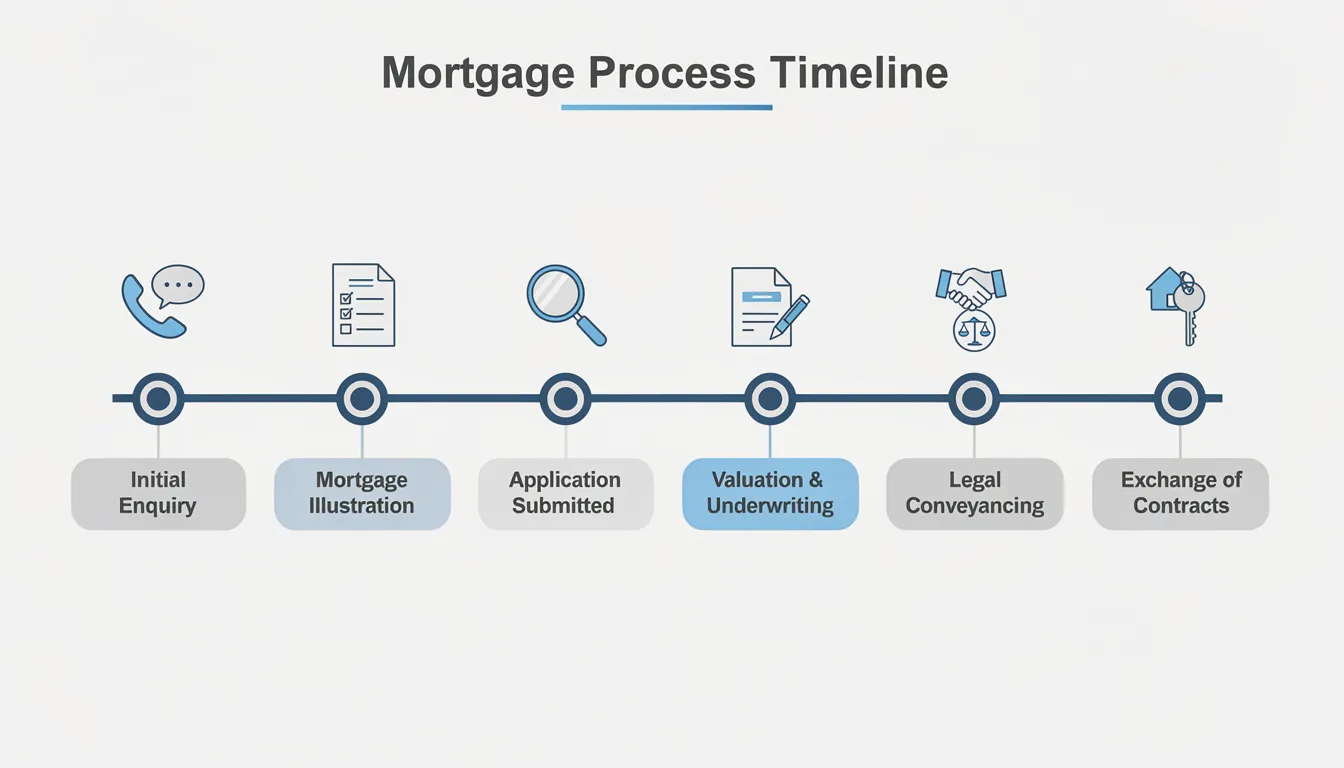

Securing an international mortgage follows a structured process, though timescales and complexity vary based on personal circumstances and property type:

- Initial consultation – We begin with a detailed fact-find covering your nationality, current country of residence, income sources, assets, currency of earnings, property plans, and timescales. This is conducted via video call or phone and takes approximately 30–45 minutes.

- Pre-assessment and indicative terms – Based on your profile, we approach suitable international mortgage lenders to obtain in-principle terms. This includes estimated LTV, rate type, arrangement fees, and realistic timescales for completion.

- Documentation gathering – You compile the required documents: passports, visas, proof of address, payslips, employment letters, company accounts (if self-employed), tax returns, bank statements, asset statements, and property details. Getting this right early is critical.

- Lender selection – We compare private & high street banks and specialist lenders based on rate competitiveness, flexibility, currency options, early repayment charges, processing speed, and appetite for your specific country of residence and income type.

- Full application submission – Your application is submitted with supporting documents. The lender’s underwriting team reviews affordability, creditworthiness, and compliance requirements. A property valuation is instructed—either a physical survey in the UK or, for some lenders, a desktop assessment.

- Mortgage offer and legal work – Following satisfactory underwriting and valuation, the lender issues a formal mortgage offer. Your UK solicitor (experienced with non-resident clients) handles conveyancing, exchange, and completion.

- Realistic timescales – Standard international mortgage cases typically complete within 6–12 weeks from full documentation. Complex structures, development finance, or cases requiring additional due diligence may take longer. Bridging finance can complete in 2–4 weeks where documentation is ready.

Documentation Required for Non-Residents & Foreign Nationals

Getting documentation right at the outset prevents delays and improves lender confidence. International mortgage applications require more extensive evidence than standard UK mortgages:

- Identity documents – Valid passport(s) for all applicants, resident permits or visas where relevant, and secondary ID if required by the lender.

- Proof of address – Recent utility bills or bank statements from your country of residence, typically dated within the last 3 months. Documents not in English require certified translations.

- Income evidence – For employed applicants: 3–12 months’ payslips, employment contract, and an HR or employer reference letter. For self-employed: 2–3 years’ audited accounts and tax returns with accountant certification.

- Bank statements – Recent personal and business statements (typically 3–6 months) showing salary credits, regular expenses, and savings patterns. These demonstrate financial stability and affordability.

- Assets and liabilities – Statements for investments, share portfolios, other property ownership, and outstanding loans. These establish net worth and overall debt position.

- Property documentation – Sales memorandum, draft purchase contract, full property details including tenure, lease length, rental projections (for buy to let), and planning permissions (for development).

- Complex structure documents – For SPVs, offshore companies, or trusts: incorporation documents, shareholder registers, structure charts, and evidence of beneficial ownership.

- Anti-money laundering (AML) checks – UK lenders and solicitors conduct rigorous source-of-funds verification, particularly where deposits are gifted, originate from multiple jurisdictions, or involve business sales. Expect detailed questioning and documentary evidence requirements.

Rates, Currencies & Managing FX Risk

Interest rates and currency management represent key considerations for international borrowers in 2026. It is essential for non-UK residents and foreign nationals to check the latest rates, as these can significantly impact borrowing costs and help in comparing available options:

- Rate types available – Fixed rates (typically 2, 3, 5, or 10 years), tracker rates linked to the England base rate, and variable rates. Many international buyers favour medium-term fixes for payment certainty, particularly given the evolving rate environment.

- Pricing tiers – Larger loans (£1m+) and lower LTVs typically access more competitive margins. Private banks may offer bespoke rates and terms for premier customers with substantial assets under management.

- GBP vs foreign currency loans – Some lenders offer mortgages denominated in the borrower’s income currency (USD, EUR, CHF, AED, SGD, HKD). Borrowing in your income currency eliminates exchange rate risk on repayments but may limit lender choice.

- Foreign exchange risk – If you earn in a foreign currency but borrow in GBP, movements in the exchange rate directly affect the real cost of repayments on your mortgage. A weakening of your income currency against sterling increases your effective monthly payments. Changes in the exchange rate may also increase the equivalent value of the debt in terms of your home currency.

- Managing FX volatility – Consider working with FX specialists who can provide forward contracts, rate alerts, or multi-currency accounts to manage volatility. This should be coordinated alongside your mortgage strategy.

Rate Types for International Borrowers

Rate Type | Typical Use Case | Pros | Cons |

|---|---|---|---|

Fixed (2–5 years) | Borrowers wanting payment certainty | Predictable payments, budgeting clarity | Early repayment charges if exiting early |

Fixed (10 years) | Long-term investors, risk-averse clients | Extended stability | Higher initial rate, significant ERCs |

Tracker | Clients expecting rates to fall | Benefit from rate reductions | Payments rise if base rate increases |

Variable | Short-term holds, imminent sale/refinance | Flexibility, often no ERCs | Uncertain monthly costs |

Complex Structures: SPVs, Offshore Companies & Trusts

Many high-value international buyers use corporate or trust structures for tax efficiency, succession planning, asset protection, or privacy. These arrangements require careful coordination between finance, tax, and legal advisers:

- UK SPV limited companies – The most common structure for non-resident buy to let portfolios. Benefits include separation from personal assets, familiar territory for UK lenders, and potential tax efficiencies (subject to professional advice). Lenders expect standard company documentation and personal guarantees from directors/shareholders.

- Offshore companies and trusts – Entities registered in Jersey, Guernsey, Isle of Man, BVI, or Cayman Islands can hold UK property. Lending against these structures is available, particularly for larger or prime property transactions, but the lender panel is more limited. Due diligence requirements are substantial.

- Additional compliance requirements – Beneficial ownership must be fully transparent. Lenders and solicitors require structure charts, source of wealth evidence, and confirmation of economic substance where relevant. Professional tax and legal advice is essential before proceeding.

- Coordinating with advisers – Fox Davidson work alongside your accountants, tax advisers, and solicitors to ensure the finance structure fits the overall ownership and succession plan. We position cases correctly from the outset to avoid delays.

- Regulated vs commercial lending – Where properties may be partly owner-occupied, the distinction between regulated and commercial lending becomes important. Incorrect categorisation can derail an application.

Bridging & Development Finance for Overseas Clients

Short-term finance solutions provide speed and flexibility for international clients with time-sensitive requirements or development projects:

- Regulated bridging loans – For UK expats selling and buying UK homes simultaneously, or downsizing, where timing mismatches make a standard mortgage impractical. These loans are regulated by the FCA and secured against owner-occupied property.

- Unregulated bridging for investment – For investment purchases, auction acquisitions, and heavy refurbishments. Completion can occur within weeks if documentation is prepared in advance. Rates reflect the short-term, flexible nature of the facility.

- Development finance for overseas developers – Funding for schemes ranging from £5m apartment conversions to £50m+ ground-up residential towers, student housing, or mixed-use regeneration in major UK cities. International developers must demonstrate experience and provide robust project viability assessments.

- Typical development finance structure – Lenders fund a percentage of purchase price (typically 60–70%) plus build costs (up to 85–90% of construction), with interest rolled up and repaid on sale or refinance. Draw-downs are linked to build stages and monitored by the lender’s surveyor.

- Exit strategies – The most common exits are refinancing onto a term commercial or buy to let mortgage (which Fox Davidson can also arrange) or selling completed units. Lenders assess exit viability before committing.

Risks, Regulation & Key Warnings

International mortgages carry specific risks that borrowers must understand before proceeding:

- Repossession risk – Your home or property may be repossessed if you do not keep up repayments on your mortgage or other debt secured on it. This applies equally to UK residents and international borrowers.

- Investment property enforcement – For buy to let and commercial investment property, lenders may appoint receivers of rent or enforce security if loan covenants are breached. Rental shortfalls or void periods do not suspend your obligation to make payments.

- Currency risk – If your income and mortgage are in different currencies, foreign exchange movements can increase the real cost of repayments and potentially your overall debt burden. A significant currency move could materially affect affordability.

- Interest rate risk – Rates in 2026 can move in either direction. Borrowers on variable or tracker rates must plan for possible increases in monthly payments if the Bank of England raises the base rate.

- Tax advice is essential – Take independent tax advice in both the UK and your country of residence before completing any international mortgage or development finance transaction. Tax treatment of UK property varies by jurisdiction and ownership structure.

- Our role – Fox Davidson arrange access to lenders and negotiate terms on your behalf. We do not provide tax or legal advice. We work alongside your professional advisers to ensure the finance fits your overall strategy.

Why International Buyers Work with Fox Davidson

Fox Davidson are award-winning UK property finance brokers. We specialise in intricate, high-value funding where standard high-street solutions fall short:

- Loan range and expertise – We arrange mortgages and property finance from £250,000 to £100m+ on UK property, focusing on transactions that require specialist knowledge and lender relationships.

- International client experience – We work with UK expats and non-residents from multiple jurisdictions, understanding complex income structures, foreign currency earnings, and the documentation challenges that international applications present.

- Broad lender access – We maintain relationships with UK banks, specialist lenders, and private banks active in the international mortgage space in 2026. This ensures competitive options tailored to your specific profile.

- Tailored structuring – We advise on whether personal ownership, a UK SPV, or another structure best suits your objectives in conjunction with your tax advisers for portfolios, developments, and prime residential acquisitions.

- Hands-on case management – We coordinate with valuers, solicitors, and lenders throughout the application process, working to realistic deadlines for completions and refinancing.

Case example: We recently arranged a multi-million-pound acquisition loan for a non-resident client purchasing a prime London property. The case involved foreign currency income, an offshore holding structure, and a compressed timeline. By identifying the right private bank and managing the process end-to-end, we delivered completion within the client’s deadline.

International Remortgaging & Portfolio Restructuring

Many non-residents already own UK property and seek to refinance, release equity, or restructure existing debt:

- Remortgaging for better rates – As 2- and 5-year fixed rates taken in earlier years mature in 2026 and beyond, switching lenders can deliver substantial interest savings. We source competitive offers from lenders comfortable with non-resident borrowers.

- Raising equity against existing assets – Release capital from UK property to fund new acquisitions, refurbishments, or overseas investments. Subject to rental coverage and affordability tests, equity release can unlock significant sums without selling.

- Portfolio consolidation – Consolidate scattered mortgages across multiple UK properties into a single portfolio facility. This simplifies management, may improve rate efficiency, and provides a single lender relationship.

- Personal to SPV transfers – Switching from personal ownership to an SPV structure may suit some investors, though this has tax implications (including SDLT on the transfer). Specialist tax advice is essential before proceeding.

Refinancing Options Comparison

Option | Best For | Key Considerations |

|---|---|---|

Stay with current lender | Minimal hassle, no legal costs | May not offer best rate; limited negotiation |

Remortgage to new lender | Better rates, access to equity | Legal costs, valuation fees, processing time |

Portfolio loan | Multiple properties, efficiency | Complex structuring, may require cross-charges |

Frequently Asked Questions: International Mortgages UK (2026)

These FAQs address the most common questions from UK expats and foreign nationals seeking UK mortgages:

Yes. Many UK lenders actively offer overseas mortgages to UK expats and foreign nationals living abroad. However, the eligibility criteria are stricter than for UK residents, maximum LTV is typically lower, and documentation requirements are more extensive. Working with specialist international mortgage brokers like Fox Davidson improves access and outcomes.

Typical maximum loan to value ranges from 60–75% for straightforward cases. Complex structures, commercial property, or applicants from certain nationalities may face lower LTV limits (50–60%). Higher deposits generally secure better interest rates and wider lender choice.

A UK credit history helps but is not essential for all lenders. Where no UK credit file exists, lenders may rely on overseas credit reports, banking conduct, employment references, and income evidence. Building a UK footprint (such as opening a UK bank account) can improve options over time.

Yes. Buy to let mortgages are common for international investors, often structured through a UK SPV limited company. Lenders focus on rental income coverage and property quality. Minimum deposits typically range from 25–40% of property value.

Fox Davidson arrange international mortgages from £250,000 to £100m+ on UK property. Our typical international clients borrow in the mid- to high-value brackets, reflecting the costs and complexity involved in overseas mortgage applications.

Allow 6–12 weeks from submission of full documentation to completion for standard cases. Bridging finance can complete faster (2–4 weeks) where documents are ready. Complex structures or development finance may take longer.

Many lenders consider these income sources with appropriate track record and evidence. Bonuses may be averaged over 2–3 years; dividends require company accounts; rental income needs tenancy agreements and payment history. Different lenders apply different weightings.

Yes. Interest-only and part-and-part repayment structures are available for borrowers with higher incomes, lower LTVs, and credible repayment strategies (sale, investments, bonuses, or refinance). Lenders assess the viability of your proposed exit strategy.

Yes. Many international investors use UK SPV companies to purchase property overseas. Lenders are accustomed to this structure for buy to let and commercial acquisitions. Additional documents (incorporation paperwork, shareholder details) and legal work are required.

If your income is not in GBP, exchange rate movements directly impact affordability. A weakening of your income currency against sterling increases your effective monthly payments. Consider borrowing in your income currency where available, or use FX hedging solutions to manage exposure.

Next Steps: Speak to an International UK Mortgage Specialist

If you’re a UK expat, non-resident, or foreign national considering a UK property purchase or refinance in 2026–2027, early advice makes a material difference. Understanding your options before making an offer allows you to move decisively when the right property appears.

Before contacting us, it helps to have the following information ready:

- Location and estimated purchase price of the property

- Your estimated deposit or equity position

- Income details (currency, source, approximate amount)

- Current country of residence and nationality

- Preferred timescale for purchase or refinance

Ready to discuss your overseas mortgage requirements?

Contact Fox Davidson for a confidential consultation. We work with clients worldwide via phone and video call, providing expert guidance on international mortgages from initial enquiry through to completion. Whether you’re investing, relocating, or securing a family home, we deliver stress free mortgage solutions for complex, high-value transactions.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements