Fox Davidson is an award-winning UK mortgage brokerage specialising in arranging private bank mortgages from £1m upwards for high net worth and ultra high net worth clients. Securing a private bank mortgage requires specialist expertise and access to lenders that are not available to the general public.

In 2026, navigating the private banking world requires expertise that goes far beyond standard mortgage advice. Our role as a specialist mortgage broker for private banks is to connect discerning borrowers with the bespoke lending solutions that private banks can offer, but rarely advertise publicly. Private banks offer mortgages with selective lending policies, and brokers provide access to these exclusive lenders for clients seeking high-value property transactions.

This article is aimed at UK and international clients looking for a mortgage broker that specialises in private bank lending on prime residential and investment properties. The minimum loan size for private bank lending via Fox Davidson is typically £1 million, with facilities regularly arranged up to £50m or more for single assets and higher still for portfolios. For high net worth and ultra high net worth clients, we provide solutions for high net worth individuals, offering bespoke, flexible mortgage options tailored to complex financial needs.

We will cover how private bank mortgages work, who qualifies, current market conditions in 2026, example case studies, and key FAQs. This is practical, non-generic guidance from brokers who work in this space daily.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements

What Is a Private Bank Mortgage in the UK?

A private bank mortgage is a bespoke home loan crafted by private banks or their specialist divisions, exclusively for high-net-worth and ultra-high-net-worth individuals. These mortgages accommodate complex financial profiles, large loan sizes (often £1 million+ with no strict upper limit), and flexible underwriting based on overall wealth and assets rather than standard salary criteria.

Private bank mortgages provide tailored terms to suit luxury property purchases, second homes, refinancing, or investment strategies that go beyond conventional high-street offerings. Unlike mortgage lending from high street banks, private banks assess borrowers on their total financial profile rather than applying rigid salary multiples or automated affordability calculators.

Private banks underwrite on total global assets, complex income streams, and ownership structures. This means they can accommodate company shareholdings, carried interest, trust structures, retained profits, and offshore entities as part of their assessment. Where many high street lenders would decline or struggle with such complexity, private bank lenders take a holistic view of the borrower’s wealth and future plans.

In 2026, typical loan sizes through private banks range from £1m to £10m as common transactions, with mortgage lending available into the tens of millions for prime central London properties, Home Counties estates, and large portfolio refinances. The mortgage product available is significantly more flexible than mainstream alternatives.

Interest rates on private bank mortgages are individually negotiated and can take various forms: tracker rates linked to the Bank of England base rate, fixed rates for terms typically ranging from 2 to 10 years, or bespoke structured products combining elements of both. Some clients prefer a part fixed, part tracker arrangement, while others opt for interest-only facilities with a bullet repayment aligned to a known liquidity event.

Higher loan to value ratios are more readily available through private banks than on the high street. While mainstream lenders in 2026 often cap at 75-80% LTV for larger loans, private banks can stretch to 90-95% LTV in specific circumstances where the borrower’s overall wealth, assets under management, or additional security support the risk. Interest-only mortgage terms are also more common, subject to a credible exit strategy and strong underlying assets.

Why Use a Mortgage Broker that Specialises in Private Banks?

Most private banks prefer introductions via specialist brokers rather than direct cold enquiries from prospective borrowers. Walking into a private bank branch and asking for a mortgage is not how this market operates. Private banker relationships are built over time, and access to credit teams typically comes through established relationships with trusted intermediaries. In fact, a personal recommendation or referral from an existing client is often required to initiate the mortgage application process.

Working with a specialist mortgage broker offers several distinct advantages:

- Direct access to senior credit teams at multiple private banks, bypassing generic enquiry channels

- Deep knowledge of each bank’s current appetite, including comfort with non-doms, crypto-derived wealth, and complex ownership structures

- Ability to negotiate not just rate but also LTV, covenant flexibility, and AUM requirements

- Experience presenting complex income sources in a format private bank underwriters expect

- Understanding of which lenders suit specific property types, borrower profiles, and geographic locations

Brokers can also facilitate the personal introduction or personal recommendation needed to access private bank mortgage products, helping clients meet the qualification criteria set by many private lenders.

Fox Davidson’s role is to package complex financial profiles clearly for private bank underwriters. A well-structured submission significantly improves both approval chances and the mortgage terms offered. We understand what each lender is looking for and can position applications accordingly.

The contrast with standard high street mortgage processes is stark. In 2026, high street lenders remain constrained by automated affordability models, strict income multiples, and limited flexibility for anything beyond straightforward PAYE employment. Many high street lenders simply cannot accommodate the unique financial needs of entrepreneurs, investors, and internationally mobile clients.

Fox Davidson maintains long-standing relationships with over 30 UK and international private banks. We can often secure mortgage options and terms that are not advertised publicly or available through direct application.

Criteria | High Street Lender | Private Bank via Specialist Broker |

|---|---|---|

Minimum loan size | Typically no minimum, but limited appetite above £1m | Usually £1m+, often better terms on larger loans |

Underwriting style | Automated affordability calculators, rigid income multiples | Manual underwriting, holistic view of wealth and income |

Acceptable income sources | PAYE, simple self-employment | Dividends, bonuses, carried interest, partnership drawings, retained profits, foreign income |

Typical maximum LTV | 75-85% on large loans | Up to 90-95% with strong profile and additional security |

Interest-only availability | Restricted, often capped at 50-75% LTV | Widely available with credible exit strategy |

Processing | Centralised, often impersonal | Dedicated private banker, senior credit team access |

Who Qualifies for a Private Bank Mortgage in 2026?

Qualification for a private bank mortgage is based on overall wealth and financial profile rather than just income. The lending criteria vary significantly between banks, which is precisely why working with a specialist mortgage adviser who understands each lender’s appetite is essential. Some private banks also require applicants to meet a minimum income as part of their qualification criteria.

To qualify for a private bank mortgage, you typically need to be classified as a high-net-worth individual (HNWI), often requiring an annual income of £300,000+ or net assets of £3 million+ (excluding primary residence, though thresholds vary by lender).

Private banks generally prefer loans from £1m upwards, with a minimum loan threshold that filters out smaller residential transactions. Maximum LTV typically sits around 65-80% as standard, rising higher where the borrower offers strong assets under management, additional security, or an exceptional wealth profile.

Private banks assess complex income with far greater sophistication than traditional lenders. They are comfortable with dividends from owner-managed businesses, carried interest from private equity, partnership drawings, retained profits within trading companies, and international income streams paid in foreign currencies. The key is demonstrating overall financial strength and a credible approach to servicing the mortgage.

Both UK-resident and non UK residents can qualify for private bank mortgages. This includes non-domiciled UK residents, UK expatriates working overseas, and foreign nationals purchasing or refinancing UK property. Each bank maintains its own country risk list and compliance requirements, but the broad range of international clients we serve demonstrates the appetite that exists.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements

Borrower Profile | How a Private Bank Might Assess |

|---|---|

Tech founder with £5m equity in a private company | Value company stake at conservative discount, consider future exit timeline, assess dividend capacity |

City law partner earning £400k plus bonus | Average income over 2-3 years including bonus, consider partnership capital and profit share |

Non-resident investor with £10m global portfolio | Assess worldwide assets, rental income from existing properties, investment portfolio yield |

Entrepreneur with property portfolio and fluctuating income | Take holistic view of assets, rental income, and business prospects rather than focusing solely on taxable income |

How Private Bank Mortgages Work: Process with Fox Davidson

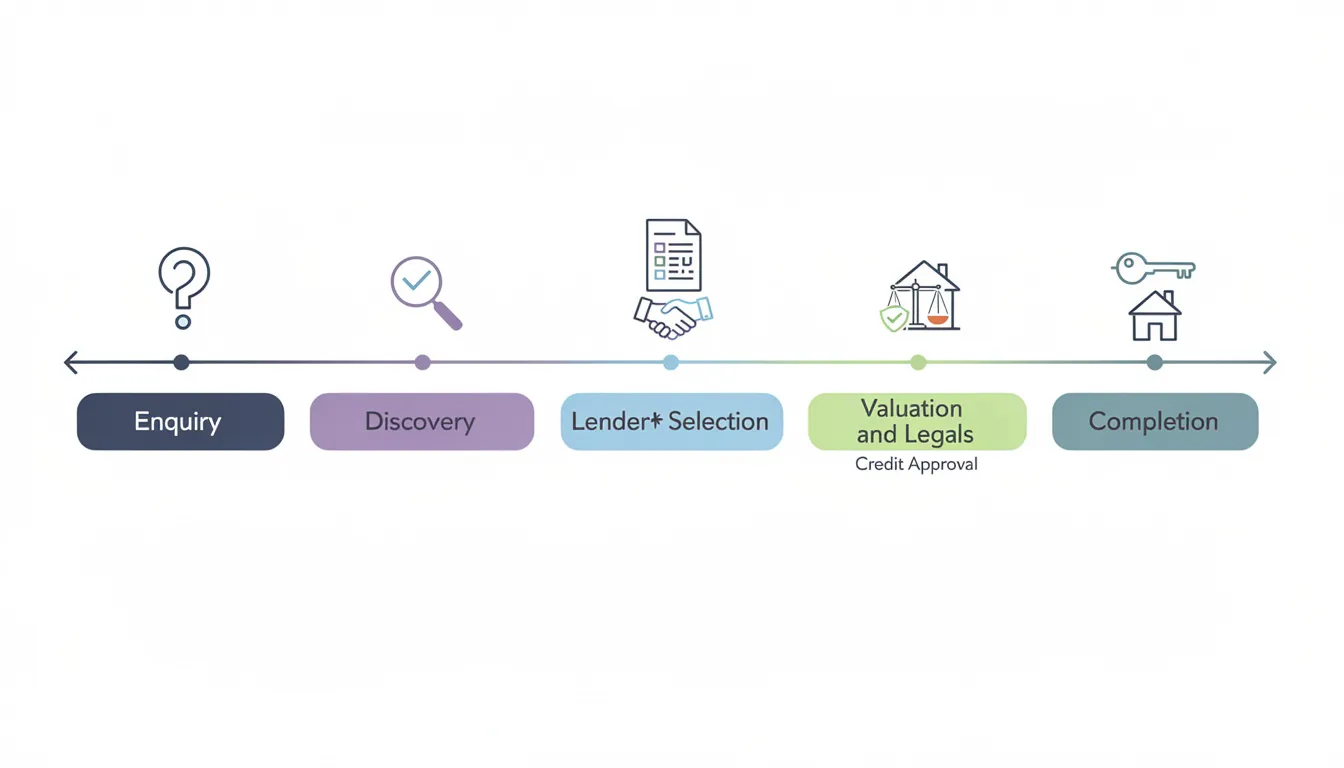

The process from initial enquiry to completion follows a structured path, though timelines and complexity vary based on individual circumstances. Understanding what to expect helps clients prepare effectively and avoid delays.

- Initial Consultation

- The process begins with a confidential discussion, whether by phone, video call, or in-person meeting. Fox Davidson gathers comprehensive details on income, assets, liabilities, property plans, tax residency, and any upcoming liquidity events such as business sales, IPOs, or bonus cycles. This discovery phase allows us to identify which private banks are best positioned to assist.

- Lender Selection

- Rather than sending blanket applications to multiple banks, we approach a targeted shortlist of private banks whose lending criteria align with the client’s profile. This selective approach protects client confidentiality and ensures each submission receives proper attention from credit teams.

- Indicative Terms

- Indicative terms can typically be obtained within a few working days in 2026, subject to preliminary documentation review and, where relevant, internal credit committee discussion. These terms outline likely rate, LTV, and structure before committing to a full application.

- Formal Application

- The formal mortgage application involves submission of financial statements, tax returns, company accounts where applicable, investment portfolio valuations, and detailed property information. The bank instructs a valuation of the security property and legal due diligence commences.

- Completion

- Realistic timelines in 2026 run approximately 2-4 weeks from initial introduction to formal offer for straightforward cases. Complex cases involving trust structures, multiple jurisdictions, or unusual properties may require longer for thorough due diligence and credit approval.

Do Private Banks Require Assets Under Management (AUM)?

Private banks often require assets under management (AUM) to secure the best mortgage terms, and some require a minimum amount of assets to be invested or managed with them as part of the mortgage agreement. Many private banks require a minimum amount of assets under management (AUM) to access their mortgage products. Assets under management refers to investable wealth that a client places with the private bank’s investment management arm. Historically, many private banks required substantial AUM commitments as a condition of mortgage lending. The landscape in 2026 is more nuanced.

Many private banks still prefer some level of AUM for premium pricing and relationship depth, but strict minimums are less common than they were pre-2020. Flexibility depends heavily on client strength, loan size, and overall relationship potential.

Percentage of Loan as AUM

- A percentage of the loan amount invested with the bank (often 25-50%)

Fixed Minimum AUM

- A fixed minimum AUM commitment, commonly £1m or more

Staged AUM Plan

- A staged AUM plan linked to future liquidity events such as company exits, vesting schedules, or bonus cycles

No AUM Commitment

- Some private banks are willing to lend with no AUM commitment for strong profiles, particularly for core UK residential property in prime postcodes. The key variables are loan size, LTV, property quality, and borrower financial strength.

Fox Davidson’s role includes negotiating proportional, practical AUM arrangements where they genuinely add value to the client relationship. Equally, we identify lenders that can offer minimal or no AUM requirements where this is a client priority. The best deal depends on your broader financial situation and preferences.

With or without AUM: which route is best for you?

Some clients benefit from consolidating banking relationships and accessing preferential mortgage rates through AUM. Others prefer to keep investments separate and accept slightly different pricing. A specialist broker can model both scenarios and help you decide.

Current Market Conditions for Private Bank Mortgages (UK, 2026)

The UK interest rate environment in early 2026 reflects the trajectory of monetary policy since the rate rises of 2022-2023. The Bank of England base rate has stabilised following the aggressive tightening cycle, and mortgage rates across the market have settled accordingly. Private bank pricing typically reflects this base rate plus a margin negotiated on a case by case basis.

For strong profiles and larger loans, private bank mortgage rates can be equal to or better than high street lenders. The combination of competitive pricing plus flexible underwriting makes private banks particularly attractive for borrowers requiring large mortgages that mainstream lenders struggle to accommodate efficiently.

Property market dynamics in 2026 show continued demand for prime London and South East property, particularly in established postcodes. The lifestyle shifts that emerged post-2020 have sustained interest in country estates, coastal homes, and properties with substantial grounds. Private banks have maintained appetite for lending on high-value main residences, pied-à-terres, and investment properties including quality buy to let.

General trends across the private banking sector include greater scrutiny of source of wealth, increased attention to ESG considerations at some institutions, and enhanced stress testing on interest-only loans. However, these changes have not diminished the fundamental willingness of private banks to provide bespoke solutions for complex cases where wealth and collateral support the risk.

Private bank margins over base rate typically compare favourably to high street equivalents for loans above £1m, particularly where the borrower profile is strong. The personalised service and tailored approach more than justify any marginal rate difference in cases where flexibility is essential.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements

Property Types and Structures We Arrange with Private Banks

Fox Davidson brokers private bank mortgages on a broad range of prime residential and investment properties across England, Wales, Scotland, and Northern Ireland. The key requirement is that the property represents appropriate security for the loan amount sought.

Prime residential property forms the core of private bank lending: central London townhouses, luxury apartments in established buildings, country houses and estates, substantial family homes in commuter locations, and high-quality new-build developments in desirable locations.

Investment property is equally viable, including single-unit buy to let, smaller portfolios of residential properties, and larger professionally managed portfolios with institutional-grade reporting. Many private banks are comfortable with properties held in UK limited companies or, where appropriate to the lender’s policies, offshore SPVs.

Private banks can often lend against properties with more complex aspects that traditional lenders avoid. Mixed residential and commercial use, listed buildings, properties with unusual construction, or those requiring modernisation can all be accommodated where the borrower profile is strong and valuation supports the risk.

Lending is available for UK residents, expatriates based overseas, and foreign nationals purchasing or refinancing UK property. Subject to each bank’s country risk list and compliance requirements, we regularly arrange facilities for clients with connections to multiple jurisdictions.

Private Bank Mortgage Structures: Repayment, Interest-Only and Beyond

Private banks can accommodate both conventional and highly structured mortgage solutions, which distinguishes them fundamentally from mainstream lenders constrained by standardised product ranges.

Standard options include capital and interest repayment over typical terms of 15-30 years, full interest-only mortgages with a defined repayment strategy, and hybrid structures combining partial repayment with partial interest-only. Flexible overpayment allowances, often unlimited, are common.

Bespoke solutions available in private banking extend significantly further. Bullet repayment structures align mortgage redemption with a known liquidity event such as a company sale, fund wind-down, or vesting of equity. Stepped repayment profiles can match increasing income from vesting schedules or anticipated career progression. Multi-currency facilities serve clients with earnings or assets denominated in currencies other than sterling.

Private banks can match loan profiles precisely to client cashflows. Low payments during investment phases or business growth periods, with larger capital reductions scheduled post-exit or post-liquidity event, represent a typical structure for entrepreneur clients.

While private banks apply prudent stress testing to assess affordability, they do so using projected income, investment portfolios, and wider family wealth where appropriate. The unmatched flexibility available means that bespoke approach structures can be designed around genuine client needs rather than forcing clients into standard product moulds.

Structure Example | Description |

|---|---|

Standard interest-only against £3m London home | Full interest-only for 5-year term at 65% LTV, repayment from property sale or refinance |

Bullet repayment aligned to 2029 company sale | Interest-only with capital repayment scheduled at expected exit, supported by business valuation |

Multi-currency facility for global executive | Mortgage denominated partly in GBP, partly in USD to match client income sources and reduce currency risk |

Fox Davidson’s Role as a Private Bank Specialist Mortgage Broker

Fox Davidson is an award-winning, UK-based mortgage brokerage with deep expertise in private bank lending for high net worth clients. Our founders and senior brokers have built their careers in this specialist market, developing the established relationships with private bank credit teams that make complex cases possible.

The firm regularly arranges private bank mortgages from £1m upwards for UK residents, UK expatriates, and international clients investing in UK property. Whether you are purchasing a prime London residence, refinancing an existing portfolio, or structuring a complex acquisition, we provide access to mortgage solutions that are simply not available through standard channels.

Specific strengths include direct access to senior private bankers rather than call centres, extensive experience presenting trust structures and company ownership arrangements, and a track record of securing approvals where standard lenders and even other brokers have been unable to assist. We understand the nuances of how private banks assess different types of clients, from City professionals to tech entrepreneurs to international investors.

Our client service approach is discreet and confidential. A single senior mortgage adviser manages each case from initial conversation through to completion and beyond. We do not hand clients off to junior processors or lose continuity mid-transaction.

If you have potential borrowing needs of £1m or more and would value a confidential review of your mortgage options, we welcome the opportunity to discuss how we might assist.

Recent Private Bank Mortgage Case Studies (2024–2026)

Case Study 1: December 2025

Client Profile: UK-resident hedge fund partner

Property: £6m prime Kensington townhouse

Loan Size: £4.5m

Structure: Interest-only, private bank tracker over base rate

Outcome: Approved at 75% LTV using bonus and carried interest history plus investment portfolio. Lender comfortable with variable income structure given strong underlying assets. Completion in 4 weeks from initial introduction.

Case Study 2: August 2025

Client Profile: Non-UK-resident tech entrepreneur

Property: London pied-à-terre plus refinance of existing UK property

Loan Size: £7.2m combined facility

Structure: Bullet repayment aligned to planned 2028 company exit

Outcome: Lender accepted company equity valuation and planned liquidity event as repayment strategy. Facility structured to minimise annual payments during growth phase. Complex structuring completed in 6 weeks.

Case Study 3: March 2024

Client Profile: UK national working in Dubai, paid in USD

Property: £2.8m family home in Surrey

Loan Size: £2m

Structure: Capital and interest repayment over 20 years

Outcome: Private bank comfortable with overseas employment and foreign currency income. No requirement to convert income to GBP pre-application. Straightforward approval despite non-resident status.

Case Study 4: January 2026

Client Profile: Family office client

Property: £10m country estate

Loan Size: £10m refinance consolidating existing lending

Structure: Blended interest-only and repayment profile with AUM component

Outcome: Consolidated three existing bank facilities into single private bank relationship. Negotiated favourable AUM terms proportionate to loan size. Achieved improved rate and simplified administration.

Frequently Asked Questions about Private Bank Mortgages

These FAQs reflect the questions most commonly asked by high net worth clients and those featuring prominently in search queries during 2026.

For strong profiles and larger loans, typically £1m and above, private bank pricing can be equal to or better than mainstream lenders. The advantage extends beyond rate alone to include flexible underwriting, interest-only availability, and structures that high street banks cannot accommodate. The best deal depends on your specific circumstances, loan size, and how complex your income or ownership structure is.

Straightforward cases can move from initial enquiry to formal offer in as little as 2-3 weeks. However, complex structures, international elements, trust ownership, or unusual properties typically require longer for thorough due diligence and credit committee approval. We set realistic expectations at the outset based on your specific situation.

Common requirements include proof of identity and address, a detailed CV or background summary, tax returns for recent years, company accounts where relevant, investment portfolio statements, trust deeds if applicable, and full property details including valuation. Private banks require thorough documentation but are equipped to assess complex materials that high street lenders would struggle to process.

Many private banks are comfortable with non-resident and foreign-currency income borrowers. Fox Davidson regularly arranges facilities for clients based overseas, paid in USD, EUR, CHF, or other currencies. Lending is subject to the bank’s country risk policies and compliance requirements, but the appetite for HNW individuals with international connections is strong.

Fox Davidson typically engages private banks for loans from £1m upwards. The exact minimum loan varies by institution and property type, but private banks are structured to service larger, more complex transactions rather than competing with high street banks on smaller residential mortgages. If your mortgage required falls below £1m, alternative specialist lenders may be more appropriate.

Not necessarily. While some private banks prefer fuller relationships including current accounts, investments, and broader wealth management, others can lend on a mortgage-only basis or with limited AUM commitment. A specialist broker will match you with the approach that suits your preferences, whether that is consolidating relationships or keeping your mortgage separate.

Lending is available on main residences, second homes, pied-à-terre’s, and investment properties including certain types of high-quality buy to let and small portfolios. Private banks assess each case on its merits, considering property quality, location, and how the acquisition fits within your broader wealth profile. Bridging loans and short-term facilities can also be arranged through private banking relationships where appropriate.

Related Guides and Resources

For high net worth individuals seeking bespoke lending solutions, understanding how private bank mortgages work is crucial. Private banks offer tailored mortgage solutions that cater to complex income structures and global assets, providing a more personalised service than traditional high street lenders. When exploring private bank mortgage options, it’s essential to consider the lending criteria and minimum loan requirements, which can vary significantly between private banks.

Private bank mortgages are designed to meet the unique financial needs of high net worth clients, offering flexible underwriting and large loans that may not be available through mainstream lenders. These bespoke solutions can be particularly beneficial for international clients, non-UK residents, and foreign nationals who require mortgage advice tailored to their individual circumstances.

To navigate the complex world of private bank mortgages, it’s often necessary to work with a specialist mortgage broker who has established relationships with private banks and a deep understanding of the intermediary market. These experts can provide guidance on the application process, help clients understand the mortgage terms and conditions, and ensure that they receive the best deal possible.

How to Get Started with a Private Bank Mortgage via Fox Davidson

If you anticipate borrowing needs of at least £1 million for a UK property purchase or refinance, we welcome the opportunity to discuss your situation in confidence.

Preparing for that initial conversation is straightforward. Gather a summary of your assets and liabilities, evidence of your income sources over recent years, details of the property you are considering or your budget range, and any upcoming liquidity events that might be relevant to structuring or repayment.

Fox Davidson can be contacted by phone, email, or secure online enquiry. Consultations are available across time zones for international clients, and we are experienced in working with hnw individuals based in multiple jurisdictions.

All information is handled in strict confidence and is only shared with selected private banks once you provide explicit consent. Your privacy is fundamental to how we operate, and discretion is central to the personalised service we provide.

Early engagement with a specialist private bank mortgage broker can significantly improve both terms and timescales. Whether you are making your first approach to the private banking market or refinancing an existing relationship, we offer the expert advice and lender access to secure the right outcome.

Contact Fox Davidson today for a confidential discussion about your private bank mortgage options.

📞 Call for immediate expert advice. 💻 Complete our enquiry form 📧 Email outline your requirements